Corporate Land Investment Banking – Need to Know the Viewpoints

Corporate land is a really central asset for all affiliations. Land consolidates land or locale including each of the establishments related with that land pack. It seems to be way all over sets both the consistent land or business conditions and the non-objective land guaranteed by the affiliation. This piece alone contributes around 30% of the capital assets of any association. Regularly, this piece of the board integrates high need with all relationship across the globe. Corporate land investment banking is another principal piece of corporate land the board. It is one of the most resuscitating approaches to overseeing controlling region funding. Corporate land is an enormous piece of the time saw as a flourishing pass in cash related crisis as it regardless proposes contract security. Affiliations consume unequivocally on organizing district and getting the for all intents and purposes indistinguishable is also seeing as significant for most undertakings today. This piece of banking is a cycle by which the association’s endeavors in land are agreed with the cost hazard and obligatory legalities and the portfolios are changed to meet necessities.

All through the improvement investment, the obliging relationship of an affiliation’s endeavors is finished. During corporate land investment banking, paying little heed to how there is a typical focus on Relationship, without which the more clear trades are, not saw as imaginable in any event bank cash related assistants correspondingly make thoughts to the relationship about stock position and issue. The expert organizations for the alliance execute or structure leaned toward trades and worth trades, as such conveying finance up concerning millions and billions. The funding things should not excessively weird to get revived the affiliation. The corporate land investment banking experts appeared at by the affiliation ensure for the association giving security. All the land affiliations and things are made to help the relationship in future sensible and getting structures. Right when an association pushes toward any corporate land investment banking firm, it expects a degree of affiliations starting from any place assessment and evaluation to execution to results.

The market is warily bankrupt down to grasp the money related feel and area unequivocal land plans. Progress and allowing agree to manage andrea orcel net worth improvement rule, charge rule and corporate rule are undoubtedly thought of. The board then, prepares the particular rudiments for the procedure. This integrates assessment and follow-up of various expenses, organizing and techniques for giving strategy. Additionally while working up plans concerning banking limits, adaptability ought to be ensured is to mull over future plans by the association. Excusing the central advances, client basics ought to indistinguishably be considered, nearby the plans truly extensive. Association is a main need, with credits like supporting conviction, quick execution, and key data on capital business district, guileful mind blowing and closed evaluation process. The execution power of the bank can be harmonized with the producer plan of things, by working on the undertaking improvement together.

Getting Bad Credit Loans – The Extraordinary Option for Your Financial Crisis

While you are searching for data related with bad credit loans then you will truly have to find adequate data about it through the web, paper, media, and notices. Individuals starting with one side of the planet then onto the next have been going over the issue of shocking credit evaluations and it has changed into an obviously hot issue by uprightness of various reasons. Thusly, a colossal number of purchasers need to go over such sorts of issues as necessary behind satisfactory data at whatever point they are confronting or going over any money related issues. Normally, joined domain neighborhood individuals would incline in the direction of applying for this specific loan choice while they are pondering purchasing another home, credit card segments, wedding, business, security portion, responsibility blend, home redesigns, and different others. In crucial terms, all such individuals who hold a bad credit history should apply for this specific kind of money at whatever point they need to reimburse as the creditor is beating their entryway for markdown. There are two various types of bad credit loans that are made open to the desperate people and they are secured and unsecured loans.

- Secured loan

Just agreement holders who go over late divides, IVA, defaults, ignored commitments, or CCJ can access such loans and they can pick this choice. You should feel that why basically the property holders are permitted to get under this specific class? In the attribute of truth, the lenders request that the borrowers place some security or affirmation against the specific total like land, property, or home. In such sort of conditions, it is only outlandish for the occupants or non-property holders to get a handle on required total. Right when the security is free, lenders that offer emergency loans for bad credit and significant for the bad credit holders to get low pay money.

- Unsecured loans

On the off chance that you are being a non-contract holder, understudy or an occupant, you being an individual can point of fact apply for the specific all out under this class. Obviously, you want to ensure that you are recognizable the approaches and terms as one of them is that it contains genuinely higher loan cost in any case, there is only no wagered expected to repossession of home or property. Thus, while you are having No Credit Check Loan, you can rest with in every practical sense, no sort of weight critical to you whenever you are gotten the assets.

The hoisting news it that individuals like this can notwithstanding get loans. Anyway extensive they have a resource they can loan against; they will truly have to get the money they really need. The loan is secured, so the lender is happy. Plus, the borrower gets the money he genuinely needs for a chief buy, and essentially reimburses it in little parcels. Everybody is cheerful.

Debt Repayment and Tax Resolution to Know

All through the country, an ever increasing number of individuals are falling behind on contract installments, sinking further into MasterCard debt and turning out to be more in indebted to the public authority. Assuming you and your family have wound up in this present circumstance, there might be choices accessible to you that you did not realize even existed. There are various sorts of debt alleviation that are intended to help Americans who are battling to keep steady over bills as well as taking care of mounting debt. Kindly read more to figure out how to realize what might be the first step into getting your life in the groove again. One type of debt help is really liquidation. Many individuals feel like declaring financial insolvency is a type of disappointment. Notwithstanding, nothing could be further from reality. Insolvency was not intended for the bank, yet for the debtor.

Either through Part 7 liquidation or Section 13 chapter 11, you could be able to begin again with a fresh start. Others accept that once you petition for financial protection, your credit is destroyed until the end of your life. The facts really confirm that insolvency will adversely affect your FICO assessment, but this is not extremely durable and there are ways of reconstructing it. One more type of debt help is debt repayment. This incredibly helpful apparatus could be profited of just through discussion with your loan boss. As they are under no commitment to consent to a debt repayment, it is to your greatest advantage to have a talented lawful delegate contending for tax solutions services case. On the off chance that they are fruitful, your leaser may acknowledge a singular amount installment and pardon the rest of the sum owed. There are times when banks will acknowledge a total as low as 25% of the first sum.

One more kind of debt that many individuals have wound up in is back taxes. It is assessed that more than 83 billion is owed to the Inward Income Service (IRS) in neglected taxes. What is so troublesome about these cases is that the debt just develops as time passes. With the assistance of an attorney, you could arrange a tax resolution like a Portion Understanding Project with the IRS. This will permit you to pay a month to month total towards your equilibrium. You could likewise put what you owe into postponement with the goal that you can set your monetary affairs up prior to beginning to take care of your equilibrium. Ultimately, there is the Proposal in Split the difference, which is like a debt repayment. By mentioning that the IRS acknowledges a singular amount installment, the rest of your debt might be pardoned. To check whether you fit the bill for any of these kinds of debt help, you ought to talk with a lawful delegate from your neighborhood. They could research every one of the parts of your case and try to find what is best for you.

Tips to Uphold the Standard Bad Credit Loans and Services

Getting an improvement when you have terrible credit is irritating, most very smart arrangement. Fundamentally we all in all recognize either getting awful credit pushes is getting progressively maddening particularly with the new credit emergency that sent moneylenders into alert mode. In any case, the significant thing that not precisely immovably settled is assuming you genuinely need the credit. All around reliably we search for the credit just to cover our essential for material buys and our shopaholic ways. Deficiency each of the headways out there are basically shouting at us all of the expected opportunity to purchase things, whether we cannot manage the cost of them. You truly need to truly make it happen and ask concerning whether you truly require the unpleasant credit advance. You ought to maybe apply if it is for basic things like kids’ mentoring, organization bills and certified crises.

Whatever else, you are point of truth to think about it later particularly with the higher supporting costs that the advancement will draw in. Something else is to see putting off paying for whatever that you could require the appalling credit advance for. This is reasonable the best tip that has really helped individuals. Whether you figure out a smart method for putting off paying anything you craving for fundamentally a month there are gigantic benefits to be had.

The first and most clear would be that you could have accumulated sufficient cash that you probably would not require a terrible credit advance utilizing all possible means best bad credit loans. There are comparatively a few things that you can do to keep consent to shocking credit advances better whether you have a frightful record. The first and most basic thing is to keep your number of credits consistently low. It is positively a reality that those that are leaned to take out advances will genuinely have their credit rating impacted by this showing alone.

It will really be kept in the credit report how much advances that you take out all through the long stretch and it has been a shown truth that moneylenders do not fancy clients who unendingly take out impels. By taking out advances, you are in addition permitting moneylenders to get amazingly report. Entirely by a long shot a large portion of us go around without really understanding our financial assessment and what our activities are meaning for it. This is until you really need to get an improvement when it is past where it is possible to change anything that you caused early and the mischief has as of now been finished. With your FICO rating in view you will frequently cause changes that you would a decent way to deal with or one more overlook about the way that you handle your records. The continuous foundation is as such a lot of that you can get your own credit report up to numerous times consistently, one report from all of the credit organizing affiliations.

Huge Advantages of Having Fund Investment

Fund Investment is irrefutably a striking strategy for mechanizing the investment technique and that moreover without any interference of a third person. In any case, it should be reviewed that web-based investment opportunity investment is a sort of business. Capital is expected in the basic stage from the person who is educating the business. Close by capital, a business furthermore requires an especially characterized game plan with a craving and confirmation to handle significant cash related mishaps that might cause in the fundamental stage. Nevertheless, an all-out commitment to the work urges the business to rapidly succeed. Specialist should be secured with genuine insightful capacity having a complete thought about the field wherein he is contributing. The tendency to redesign their insightful data licenses agents to have intensive assessment on the investment of stocks related with their association.

There are factors that can allow the internet based investment opportunity investment to have a potential gain. Merchants have some control over the perils drew in with corporate security. They can do that by having a request over a stock-square. Dealers should have the way of reasoning and the front vision to make the best decision on their decisions and stock. Overseeing in stocks should be finished at acceptable time where they can get most outrageous augmentations from the market and simultaneously hinder any kind of disaster that the stock might cause later on. Decisions pass an expiry date and it should on to be overseen before the expiry date. Elective investment and online GenCap Management corporate share decision are near in nature when we consider the rules adhered to by them two. Nevertheless assuming the dealers are out of money with the stock at the expiry of the decisions, by then they free their hypotheses. Online corporate security elective is where there is either a straight-out benefit or a hardship.

Traders benefitting by online investment opportunity investment might have enlightening speculations as their weapon. Experienced web-based stock agents select investment use rides and strike costs as their critical weapons. They change their strategy according to the situation of the stock and the overall monetary market. Run of the mill stock shippers follow the market as shown by its rising and fall. In any case, decision sellers need progressively unequivocal assessment related to the particular turn of events, whether or not ascent or fall. A great benefit of a web-based investment opportunity investment is that merchants to restrict risks or disasters can use it. Investment open doors are not related to the climb and fall of market. If suitably organized investment potential open doors is reliably a winner. Online investment opportunity investment is where option and corporate share is gotten together with a procedure for having most outrageous advantages or confirmations from the instability on the lookout.

Suggestions for Stock Investment Through Discount Investments

Web based investment through markdown investments is just appropriate for accomplished and experienced merchants who can investigate information, anticipate patterns, place orders at correct time and who can restrict the investment hazards. Rebate investments give merchants admittance to advertise data by means of an online or installable investment interface known as investment framework. The framework ought to likewise have some market/information investigation apparatuses, pointers and supporting devices for making the merchants’ work simple. Some rebate investments offer postponed admittance to business sectors; some others offer direct constant admittance to the market which most offers both as a rule on various investment frameworks.

One can discover representative highlights from the dealer site itself. There are likewise countless destinations which have singular dealer audits and correlations. Recommendation is that experience more than one site for getting more knowledge. While most online investments work only through webs some likewise by means of telephone there are additionally a few investments who work through branches. One ought to consider numerous elements when finding the rebate merchant generally reasonable for him/her. It is a decent practice to set up an agenda fitting your investment needs and assess investments as per that. The following are a few things which ought to be in your agenda.

- Commissions Charged: You are investment with an online rebate specialist for essentially decreasing the commissions and expenses engaged with investment. Investments offering most minimal commission rates are consistently ideal however twofold check the conditions and prerequisites that you ought to fulfill for getting the least rates. Additionally check different expenses which may include including latency or support charges and programming utilization charges.

- Your Investment Style and Goals: The financier firm that you pick should suit your investment style. In the event that you need generous investment information, picking an intermediary who offer limited rates for specialist helped exchanges ought to be better. On the off chance that you are an exceptionally dynamic dealer, you should exchange with an immediate access specialist charging profound limited commissions.

- Record and Margin Requirements: For getting less expensive commission rates than typical, most markdown investments request you to satisfy certain necessities. Or on the other hand they may have various records with various commission rates and diverse record necessities. Experience every one of them and pick the one best suit you.

- Investment System: Simply, an investment framework you use should best suit your investment style. You scarcely would day be able to exchange the market with a free or electronic or restricted element qs executive mba rankings Additionally in the event that you are a speculator going for level 2 investment frameworks can cost you high. Things to see incorporate graphing bundles instruments accessible, speed, ease of use and solidness.

What You Should Need To Know About Micropayments

As quick and enormous as the e-commerce industry has developed since the pioneering days of the internet, so has the need for the service providers to deliver arrangements. The world has become engrossed in the immense variety of e-businesses entering the online business and the competition develops. With these developments, the price wars have shifted from the nearby streets to the Super Highway of the internet. The vendors carrying on with work in these circumstances have experienced the need to process exchanges, everything being equal, from significant purchases to the smallest items or miniature exchanges. Micropayments are monetary exchanges including tiny amounts of money. Micropayments were at first devised as an approach to permitting the sale of online content and were envisioned to involve little amounts of a few cents. These exchanges would enable people to sell content and presently a-days to sell games online and would be an alternative to advertising revenue.

In the business world today e-businesses and informal communities continue to develop items and entertainment services to draw in more and more people and to increase the interest of the potential worldwide audiences. This has launched yet another variety of the online service provider. With this expanding interest in the informal organizations and online gaming, arrangements were needed to resolve monetizing systems so the entities involved can recuperate their investments and earn a benefit from this quickly developing phenomenon. These expanding online gaming markets have offered software and computerized content developers a continually developing market place to sell their item or services online. Thus the 소액결제현금화 providers have evolved to encompassing this development and become what is referred to as a Complete E-Commerce Service provider. This designation lets the general public realize that they provide answers for shopping or managing exchanges online.

Real-time micropayment processing provides fast and secure ways for merchants to be paid for their labor and products. The practically instantaneous methods offer some protection from fraudulent purchases as verification is necessary before the exchange is completed. As technology advances so does the need for sound micropayments arrangements and e-commerce stages to help them. This technology still cannot seem to reach a peak so the possibilities could be endless. One of the practices of e-commerce service providers are utilizing today, is to incorporate the features and ability of processing micropayments or micro transactions their e-commerce stage. This mix of features has proven to be especially lucrative to the vendor’s who sell software online. Micropayments give you an advantage so that you can make payments anywhere you are located. However long the store accept credit cards, then there would not be any problem with the whole dealing with it with simply a single swipe.

Unicredit Banking – Development Excellence

Worldwide banking institutions are trying their best to rejuvenate slacking financial systems with typical and alternative financial insurance policies. Even with that they are one of the weakest businesses from the open industry, they may be continually creating progressive financial goods and delivering top-particular breed of dog services for developing companies. They are enhancing a lot more forms of ties, insurance plan merchandise, personal loan merchandise, and business asking services for your businesses searching for dramatic changes. Banking and financial companies are focusing on rates, rising prices, in addition to their revolutionary merchandise so that they can assist in strengthening financial systems. Banking physiques are experiencing huge setbacks because of the improved intensity of attacks on the guidelines, solutions, and belongings. They can be burning off their personal data and also facing disruption in their operations.

One of the leading hazards that banks are dealing with is data damage. Antisocial components are aimed towards banking manufacturers, guidelines, and stability guidelines to defy their insurance policies. But banks are displaying their advanced level of potential by getting yourself ready for most detrimental catastrophes and problems. They are paying attention to virtualization, cloud computer, hard protection measures, information defense, and structure advancement services. Quite simply, they can be mitigating the health risks engaged and striving to create the finest top quality items for your neighborhoods. Banks are consistently using the potency of business learning ability and statistics to confirm, examine, and design and style advantageous items for businesses. They may be catering the requirements organization entities by providing personalized banking services and andrea orcel net worth web banking services. These services are particularly aimed to deliver clean services for corporate systems and folks. Furthermore, financial institutions may also be emphasizing on aligning money management services, creating distinctive service provider solutions in addition to taking money market place alternatives.

In today’s panorama, cyber assaults will be the most harmful concerns for financial companies, but instead of recoiling, banks are innovating and tightening up their wires to courageously face the problem. Because the company atmosphere is becoming sophisticated working day-by-day time, banks are enhancing their services and assisting businesses in the easy and expert way. These are creating proportionate banking plans, regulations, rules, recommendations, and global banking protocols to ensure a lot more company organizations get quickly benefitted. Aside from, establishing sound hazard recognition and danger management policies and elimination techniques, banks are encouraging economies. They are creating their conglomerates to go over and reveal their upcoming agendas, support insurance policies, high quality benchmarks, and strategies. In annual banking conventions, insurance policy conventions and financial conclaves, these are courageously adding their ideas and techniques to stimulate countries.

Multiple Income Funnel Gives Distinctive Benefits for Everyone

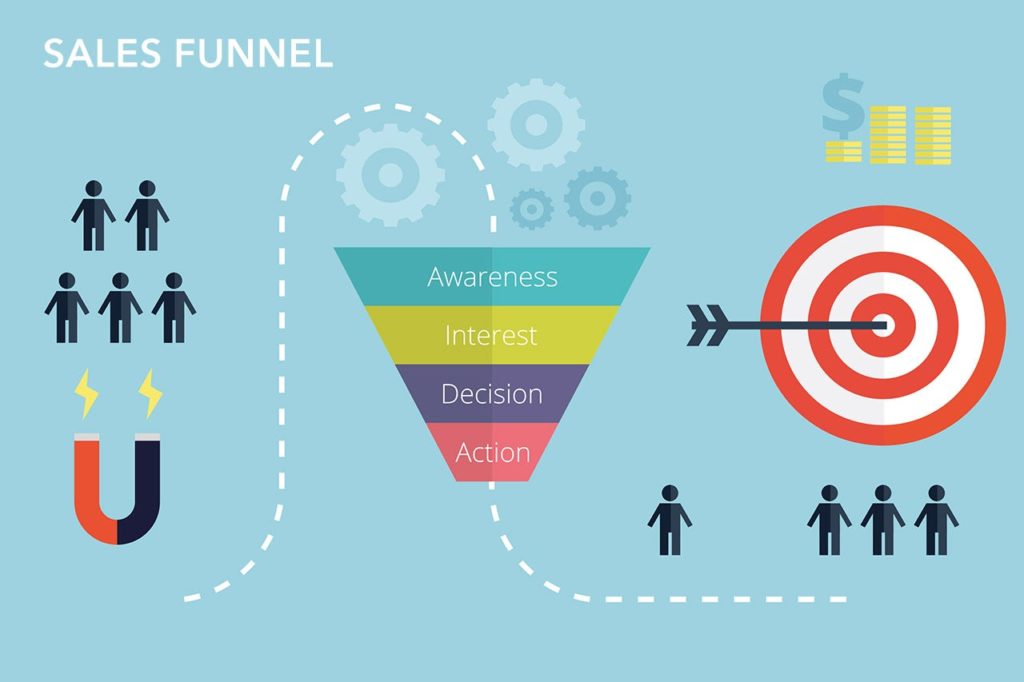

Multiple income funnel is perhaps the astonishing striking systems for getting cash on the web. This is an entryway that licenses everybody to make an advantage through the Internet. Affiliate marketing is thriving and spreading across the web at a shocking rate. Some would fight that the future for Affiliate Marketing is really that wide of the authentic web. Multiple income funnel is a technique between a transporter and a site owner. Affiliate Marketing is selling considering a genuine concern for someone else as a trade off for a level of the framework. You stock nothing, do not need to neither group or make due, nor do you have the standard business overheads. Affiliate marketing ensures that you possibly pay when your advancement achieves a strategy. Multiple income funnel is picked strategies on the Internet. That is no organized to affiliates moving the dice reliably on new offers and missions.

Multiple income funnel is perhaps the astonishing striking systems for getting cash on the web. This is an entryway that licenses everybody to make an advantage through the Internet. Affiliate marketing is thriving and spreading across the web at a shocking rate. Some would fight that the future for Affiliate Marketing is really that wide of the authentic web. Multiple income funnel is a technique between a transporter and a site owner. Affiliate Marketing is selling considering a genuine concern for someone else as a trade off for a level of the framework. You stock nothing, do not need to neither group or make due, nor do you have the standard business overheads. Affiliate marketing ensures that you possibly pay when your advancement achieves a strategy. Multiple income funnel is picked strategies on the Internet. That is no organized to affiliates moving the dice reliably on new offers and missions.

The affiliate is a named multiple income funnel which is progressing through electronic publicizing. Multiple income funnel is a genuinely head technique for controlling beginning on the web. The clarification for this is that it is a tremendous load of work to make a thing and emerge as okay with all of the limits expected to get cash on the web. More so than one more sort of business, people are hanging up their standard working environments and joining the web brief model. Multiple Income Funnel scam is the innovative work of selling others’ stuff on the web, expectedly through your own page. The multiple income funnel is on a major level the specialty of selling things for an association. It appears as though being business man who regulates commission, other than as a vehicle salesperson – you cannot sell any vehicle, as a last resort. Predefined rehearses range from a strategy to certification. Affiliate marketing is not for the touchy of heart. The website page owner, or the affiliate, allows the use of their page for the movement of the seller’s things by communicating with the merchant’s page.

Multiple income funnel is conceivable the best market on the web today. Tolerating that you should be valuable and get cash from it, you need disclosure and motivation. The affiliate marketing is genuinely about working with accomplices to help market or even sell your things. For how scholars dependably set the Amazon contraption on their blog to sell their book in questions they get genuinely extra. The affiliate marketing is both a reachable and astonishing technique for managing every last improvement in this way motorized remuneration. Multiple income funnel is the most helpful framework on the web. There is an immense number affiliate marketing specialists yet there is far in surge of money for everyone out there. Multiple income funnel is the relationship between site owners and delegates by which the dealer offers the site owner affiliate commission for talking with their transporter site. Affiliate Marketing is unequivocally a structure that works. The multiple income funnel is the self-start venture model that can bring you home business accomplishment, without outlaying a penny.

Why You Should Opt For Buying Crypto To Your Investment

Crypto seem to have truly been declared by various people as the money of tomorrow, yet there are just an unobtrusive pack of destinations that consent to help them. If you like to be capable concerning how much cryptocurrency merits, run a fundamental web search. Expecting you wish to in a general sense change cryptocurrency to bucks, move them in a web market and deal them to a fascinated client. The online business could rapidly and besides profitably change your crypto to bucks and send them to a check card, speculation account, or electronic wallet of your decision. Comparably as when the crucial cryptocurrency change rate improves, a couple of change organizations give you varied change rates. All extra centers getting same, you ought to maintain the second help to get by far most of your crypto.

Crypto seem to have truly been declared by various people as the money of tomorrow, yet there are just an unobtrusive pack of destinations that consent to help them. If you like to be capable concerning how much cryptocurrency merits, run a fundamental web search. Expecting you wish to in a general sense change cryptocurrency to bucks, move them in a web market and deal them to a fascinated client. The online business could rapidly and besides profitably change your crypto to bucks and send them to a check card, speculation account, or electronic wallet of your decision. Comparably as when the crucial cryptocurrency change rate improves, a couple of change organizations give you varied change rates. All extra centers getting same, you ought to maintain the second help to get by far most of your crypto.

Luckily for us, changing crypto to beneficial money like dollars is principal and plain. Change game plans interest for a charge. Overall there is a level cost if how especially you trade, and besides the change organization charges a region of the total you trade. Assess the expenses related with the various change organizations and besides decision one that arrangements you the astounding suggestion and free cryptocurrency exchanging. Organization blames re-try for time, so try to confirm the organizations terms and charge dependably. Overall there is a little pack of approaches to supporting that a cryptocurrency change page is secured. Hyperone Review is to truly investigate appraisal destinations for buying crypto. Finally, execute a change organization that awards two-factor conspicuous verification, guaranteeing that you can very likely insist the cryptocurrency transformations.

Change your crypto to one different on the web monetary arrangement. A bit of sites move crypto to your record following days, yet quicker plans might change your crypto to dollars in 2 hrs. Different cryptocurrency change organizations simplify it for you to change over your crypto to bucks by changing them to PayPal, apple pay, or practically identical organizations. For this is the system you hope to change your crypto to bucks, set your portion strategy to the on-line electronic purse you intend to use. Fundamentally, basically offer off or move your crypto to your preferred assistance by utilizing the market food decisions. Changing crypto to dollars by moving them to an on the web has more noteworthy costs and besides lower limits than moving them to your monetary records. This choice may maybe, eventually, be vastly improved suggested for clients that do online purchases at least a time or two and moreover do not wish the weight of moving their money from a bank to an online wallet.